Why the Need for Asset Components?

Objective: To discuss why assets are componentized and identify the typical asset components configured in the Brightly Assetic Register.

Definition of an Asset Component

Many infrastructure assets (non-current assets) managed by various industries, comprised of multiple elements to enable them to deliver the services that they were designed for.

When an asset consists of different elements (components) that are considered to be significant in relation to the management or financial value of the asset, they are referred to as Complex Assets. This is because each component is considered to have significant value in relation to the cost, service level, useful life and/or consumption pattern (life cycle degradation profile) of that asset.

Typical complex assets are:

- Special purpose buildings, components may include the roof, external walls, electrical and fire safety systems, mechanical, super-structure and substructure.

- Road infrastructure, components may include the surface, pavement-base, pavement-sub base, formation (initial earthworks).

- Water, sewer and storm-water networks, components of these asset types generally refer to the network and can include distribution systems (water mains), water filtration systems (including pumps & electrical), dams, reservoirs, etc.

A complex asset can be understood further using an example of an administration office building (being the asset type). This type of building will comprise of (but is not limited to) components such as the roof, the external and internal walls and the foundations which together enable the asset to deliver its services.

It is considered good asset management practice to componentize complex assets, as they not only comprise of components that have been constructed using different materials and designs, but have varying replacement costs, useful lives and/or life cycle degradation profiles, which impact on strategic modelling and valuations, and more importantly how the asset is managed.

These components may also display other attributes that would warrant componentization such as different maintenance practices and risk or criticality factors.

Asset Life Cycle Modelling and the Role of Components

Life cycle management is an essential part of good asset management planning.

From a strategic life cycle modelling perspective, identifying, recognizing and performing condition inspections at a component level will provide the asset custodian with the necessary information to manage each asset according to how different elements of the asset are consumed in their everyday environment to deliver services to the community/customers.

There are times when recording information at the asset level is appropriate. However, when dealing with complex assets more detailed information at a component level is warranted because the components have varying useful lives and degradation profiles as a result of their design and this information are required to help manage the asset.

The following example illustrates the limitations of managing complex assets at a higher level and the benefits of managing complex assets at the component level, with regards to asset life cycle modelling and strategic asset management decisions.

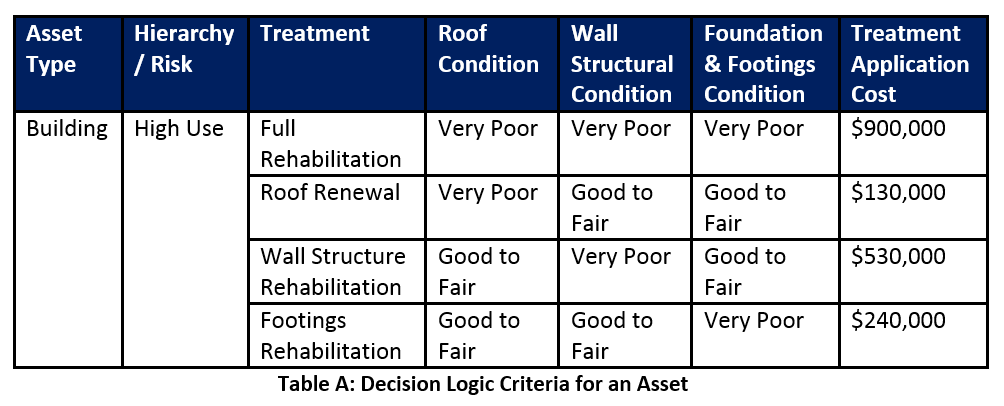

In this example, the decision logic criteria for a building assets recognizes the following parameters which will be utilized when carrying out asset life cycle and financial modelling and to select candidates[1] for the capital works program.

[1] A candidate is an asset or component that has been nominated for a specific capital works treatment i.e. Roof Renewal on a building.

In this example, there are four types of treatments that are able to be performed on a building asset, when certain criteria are met.

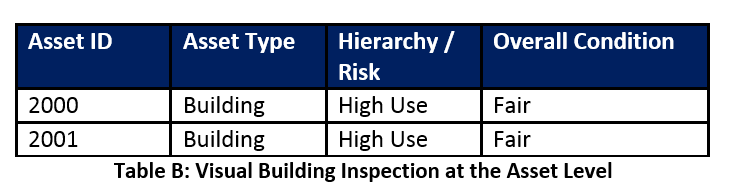

If our inspector performed a visual inspection and returned the following data, there would be insufficient information available for the asset manager to determine what the appropriate treatment would be, if required at all.

Undertaking a condition inspection at a building level (asset level) as recorded in the above example, unfortunately, does not tell us much in terms of what works need to occur and when. Unless all of the building components have failed at the same time and the building is rated as very poor, from the visual inspection data, we cannot select any treatment apart from full rehabilitation, which is often the most expensive treatment.

The reality is that each of these building components degrades and are consumed at different rates, which means that typically, it will be unlikely that all of the building components will fail at the same time.

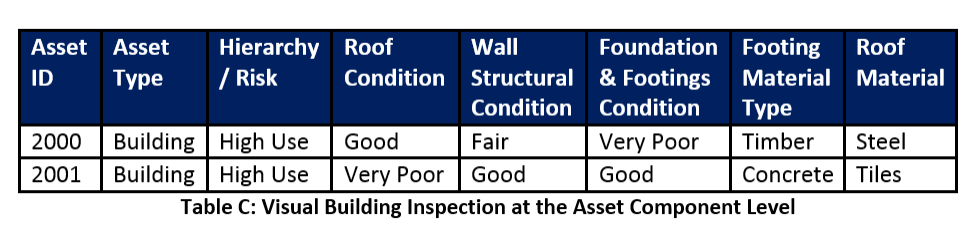

However if our inspector performed a visual inspection capturing the following information at a component level, this would provide enhanced data that can be turned into useful information for decision and management purposes.

Utilizing this componentized dataset, we can easily identify that asset 2000, would be a candidate for Footing Rehabilitation works (where the timber stumps are removed and replaced with new concrete stumps) at a cost of $240,000. We are also able to identify that asset 2001, would be a candidate for a Roof Renewal (where the existing terracotta tiles are removed and replaced with new tiles) at a cost of $130,000.

Why the Need to Componentize from an Accounting Viewpoint?

The International Accounting Standard (IAS) 16 Property, Plant, and Equipment, requires that assets made up of materially significant parts, which in turn have materially different life cycles, must be depreciated separately.

In such cases, separately identifying, recognizing and depreciating each of these significant components, will provide better reliable and relevant information to asset and financial managers and ensure compliance with IAS 16.

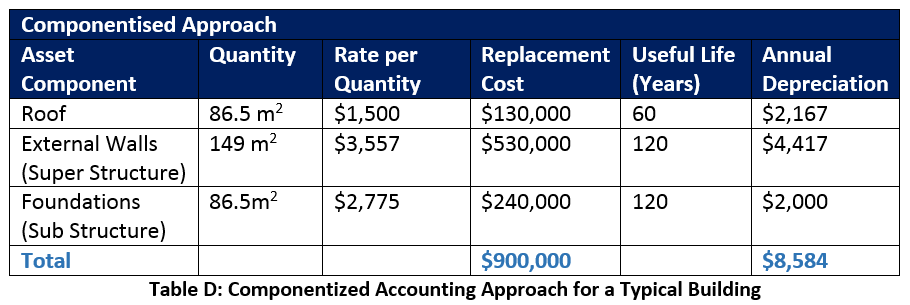

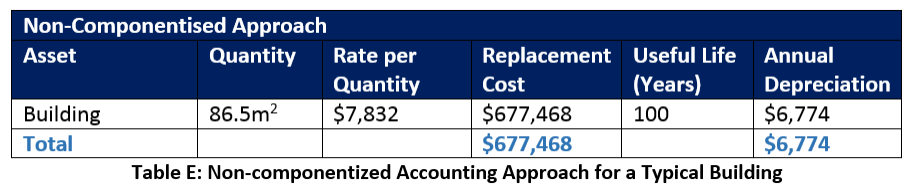

The following provides an example that illustrates the componentized accounting approach compared to a non-componentized approach, using three main building components in this example for simplicity purposes.

In the above Tables, the annual depreciation is calculated using the straight-line approach; Replacement Cost divided by the Useful Life (number of years that the asset or component will be in use, providing a benefit).

As a result of using the non-componentized approach, our building asset is valued and depreciated at the asset level. This approach results in a 15% difference in the replacement cost of the asset and 21% difference in the annual depreciation rate when compared to the componentized approach.

Identifying, recognizing and depreciating complex assets using the componentized approach provides improved reliability and more relevant information to support the organization's Balance Sheet and asset management financial forecast planning.

Using the componentized accounting approach allows asset custodians to calculate a total replacement rate by summing the replacement costs of the individual components. The annual depreciation rate is then determined to take into account each components design/useful lives based on its construction and material attributes, ensuring that the financial statements are not materially miss-stated.

Each organization will need to consider their own circumstances when making a decision on what is material, in consultation with their finance accountants and financial auditors. As a rule of thumb, any difference in replacement costs and depreciation expense, greater than 5-10% is generally considered material.

When Should Assets be Componentized?

Complex assets are typically componentized when the Componentization Framework criteria are satisfied. This means that each component:

- Must be separately identifiable, measurable and able to be separated from the complex asset; and

- Requires the application of different useful lives and/or degradation profiles; and

- Can be renewed/replaced independently of other components during the life of the complex asset; and

- Has a substantial value relative to the complex asset, which exceeds the organization's asset recognition threshold; and

- Failure to componentize will result in a material difference in the annual depreciation for the asset.

Brightly Assetic Assets Register, by default, configures component types based on the Asset Category.

This downloadable spreadsheet provides the list of the Component Types per Asset category, as configured by default in the Assetic Assets Register. This is not intended to be a definitive list, as these asset components can vary depending on your organizations business needs and/or statutory financial reporting requirements.

Tip: Assets comprising of various significant elements, must be componentized. A componentization framework has been provided as a guide.

Complex assets with significant components which have varying useful lives and/or degradation profiles, if not accounted for correctly, will have a material impact on the organizations non-current asset financial values.